The Best Approach to Handling Major Hotel Property Damage Insurance Claims

Authored by:

Luis R. Esteves, Principal & Executive General Adjuster

Jansen/Adjusters International

How can the right public adjusting team help you obtain a full settlement?

In the wake of COVID-19, hoteliers already have their hands full retaining key employees and good cleaning companies while filling as many rooms as possible to prevent more loss of income.

Significant property damage from a hurricane, fire, or other disasters can interrupt this recovery indefinitely. The hotelier will also have to handle the complex and unfamiliar process of preparing a precise property damage insurance claim.

The biggest challenge will be coordinating and managing all aspects of the claim and the many parties involved.

The insurance company will bring its claim experts to protect its interests. Restoration companies, engineering firms, and accounting firms will be involved, too, presenting their own opinions.

Right away, the claim becomes a full-time job and an unnecessary burden for the hotelier to handle alone.

That is why hoteliers in Texas and the south call on our public adjusters to be their advocates and handle the claim process on their behalf to get them back in business sooner.

Our public adjusters are experts in property damage claims and are fluent in the specialties of each party involved. We run point on the whole claim process, providing a custom approach that aligns all decisions by all parties towards securing a full settlement for the hotelier.

Major Business Decisions After A Loss Does preparing a property damage insurance claim feel unfamiliar?

Check out these tips below.

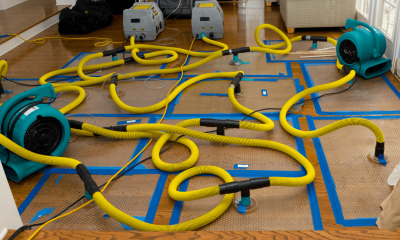

Mitigation vs. Rebuild

Is it better to spend funds on mitigation? Or is the loss so extensive that a complete rebuild is in order? The answer lies in your policy's sub-limits.

Get a Second Opinion

During reconstruction, the opinions of the engineers and the remediation and restoration companies can significantly impact your claim. Obtain your own team of insurance experts for a small fee.

Negotiate Alternative Recovery Options

The typical claim process includes agreeing on the scope of the damage, preparing the cost estimates or bids, and then reaching an agreement on costs.

Stay Open Vs Closed

Do you want to shut down operations and only open after restoration is complete? Or do you want to avoid a larger loss of income and stay partially open? Doing the latter may entice your insurance company to expedite the claim.

Agree On Scope of Loss

Contractors may recommend short-term solutions that are not in the best long-term interests of the insured. Hurried financial commitments made early in the process can result in disagreements with the insurance company on the scope of the loss.

Your public adjuster and the insurance company's adjuster must agree to these decisions early on because they are the foundation for finding common ground as the claim moves towards a settlement.

1. Mitigation or Rebuild? The answer lies in your policy sub-limits.

- Is it better to spend funds on mitigation? Or is the loss so extensive that a complete rebuild is in order?

- Does the insured's policy provide enough coverage to allow for mitigation and a complete rebuild?

- How do the policy sub-limits affect the availability of funds to make both scenarios happen?

We help hoteliers understand these kinds of options in their policy. However, we also make them aware that, at times, contractors may recommend short-term solutions that are not in the best long-term interests of the hotelier.

Hurried financial commitments made early in the process can result in disagreements with the insurance company on the scope of the loss. This sense of urgency is all the more reason to have a trusted public adjuster by your side immediately after the damage.

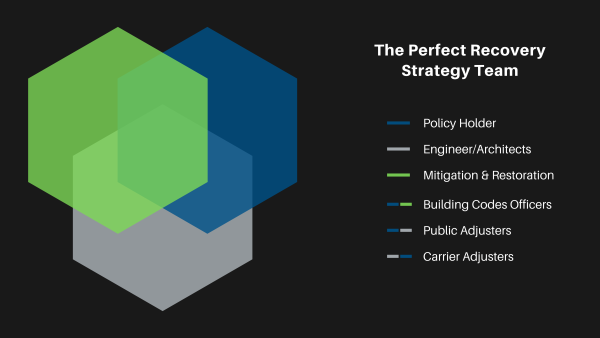

2. A comprehensive recovery strategy starts with a coordinated action plan.

In a "perfect claim world," all experts would meet to plan out the whole scope of the loss process and valuation of the claim. Ideally, the experts typically participating would include:

- Public adjusters

- Building estimators

- Contents Inventory Specialists

- Insurance carrier's adjusters

- Engineers/Architects

- Mitigation and restoration companies

- Municipal building codes officers

Unfortunately, we rarely find ourselves in the "perfect world" when a significant property damage loss is concerned, so orchestrating a "perfect" scenario is something hard to achieve — but our public adjusters have a considerable advantage.

After decades of successful commercial claim management throughout Texas and the south, we are beyond familiar with dealing with the complex claim process for hotel property damage and the diverse group of experts involved. However, we also have the reputation and relationships to ensure trusted, and efficient professionals work on your claim without delay to secure a full settlement.

"If a property damage claim were a symphony, all the experts would have different instruments — but they would be playing in concert instead of to the tune of their interests."

We make sure your claim team — including the remediation or restoration company — is working toward the common goal of doing what is needed to benefit you, the policyholder.

When deciding on mitigation and restoration efforts, the opinions of the engineers and the remediation and restoration companies can significantly impact your claim. A Jansen/AI public adjuster is your sounding board on these opinions and can present effective long-term solutions outlined in your policy. Our adjuster and the insurance company's adjuster must also agree to these early decisions because they are the foundation for finding common ground as the claim moves towards settlement.

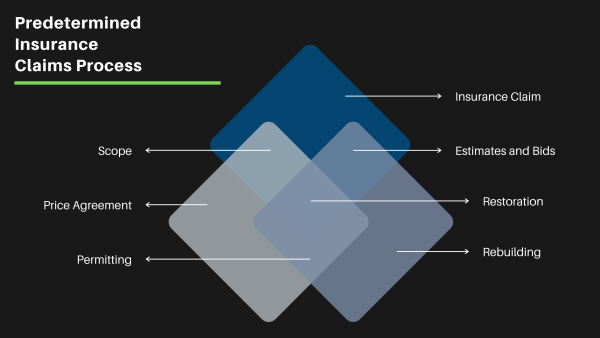

3. Negotiating payment keeps the restoration moving toward completion.

The typical claim process includes agreeing on the scope of the damage, preparing the cost estimates or bids, and then reaching an agreement on costs. Following the settlement of the claim are the usual permitting and rebuilding stages to complete the actual restoration. Insured hoteliers will most likely know and expect these processes.

Our public adjusters handle many other necessary parts of the claim that are often invisible to the hotelier:

- We lead negotiations with the insurance company's experts. Their team of experts includes:

- Engineers

- Building consultants

- Independent adjusters

- Desk adjuster

- Wholesaler/broker

- Reinsurance groups for multi-layer policies

- We consider alternative mitigation and restoration scenarios that significantly impact loss estimates. For example, does the hotelier want to shut down the entire property and only open it after restoration and cleaning? Or do they want to avoid a more considerable loss of income to themselves and the carrier by staying partially open while the damaged areas are being rebuilt and cleaned? This second option could entice the insurance carrier to expedite the claim.

- Provide professional reasoning for specific recovery alternatives that will be in the best interest of the hotelier and that the insurance company will accept.

- Assist with reinsurance or multiple layers of coverage issues.

- Engage municipalities for building code interpretations. Usually, one must meet code issues on older buildings, and coverage is generally limited. Our public adjusters identify what is required by the local authority, evaluate the policy coverage for code upgrades, and present a claim to secure the proper amount for the upgrades.

- Determine early on if the hotelier's bank will be controlling the settlement funds and what process will be involved to release these funds and determining when to give those monies back to the hotelier.

- Request advance payments to ease the financial strain on the hotelier.

For decades, our well-honed adjusting approach has earned us an outstanding record of success with hoteliers and other commercial property owners.

When all parties involved in the property damage claim work together, the hotelier benefits the most. Excellent customer service should be about the insured regardless of which side of the aisle the professional represents.